- HP 10BII FINANCIAL CALCULATOR AMORT MANUAL

- HP 10BII FINANCIAL CALCULATOR AMORT LICENSE

- HP 10BII FINANCIAL CALCULATOR AMORT PLUS

HP 10BII FINANCIAL CALCULATOR AMORT PLUS

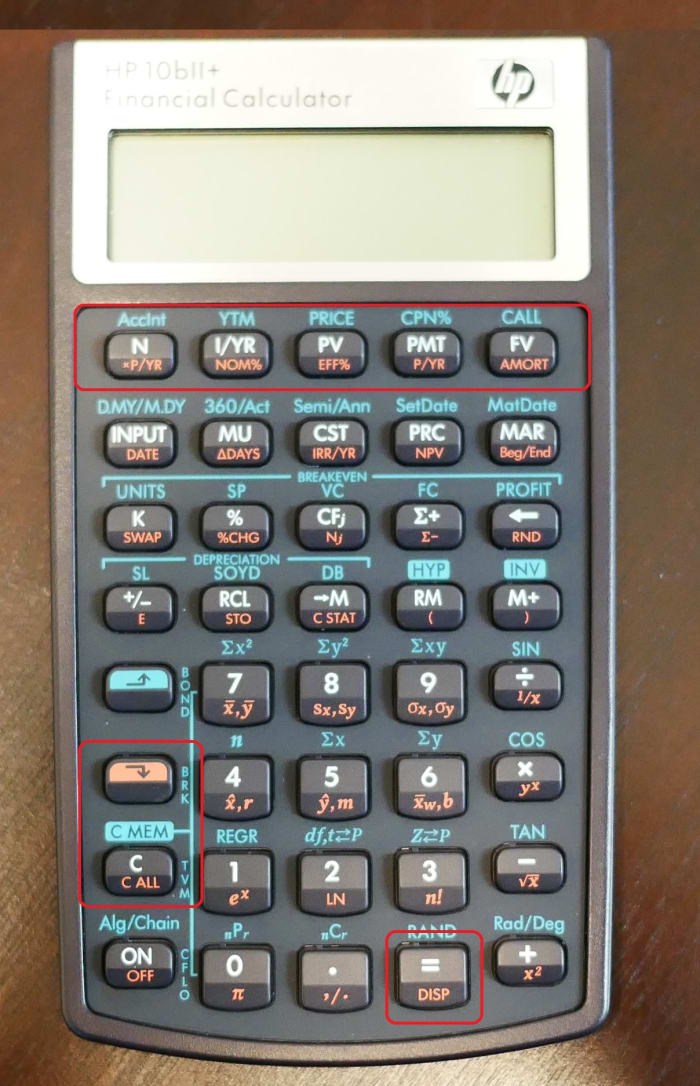

Doing this User Guide example and seeing the $0.02 difference is what prompted me to look into these details. We go through an example of a mortgage loan using the HP 10bII Plus Financial Calculator amortization schedule. 84 value is the full-resolution value, likely found by the User Guide author using higher display resolution and then manually rounding to cents resolution. In this lesson, we explain and go through an example of calculating Payment PMT & Total Interest Using HP 10bII Plus Financial Calculator. If the calculator display resolution is the default cents (as implied by the ".84" in the answer) the calculator value is -1,579.8 2.

HP 10BII FINANCIAL CALCULATOR AMORT MANUAL

The manual shows PRINciple paid after the first 12 payments as "-1,579.8 4". There is a related defect in the HP 10bII+ User Guide p76 example. I made an Excel spreadsheet with 360 rows to prove to myself this is what is going on. But with cents display, you end up with a BALance of $3.00, which is correct if you made actual monthly payments to cents resolution for 30 years. With high resolution you end up with a BALance of $0.00 as expected. But now find amortization results for the last payment (#360) with display resolution set to 2 (cents, the typical default) versus 9 (or any high resolution). This is very useful, documented in the manual appendix that shows equation details, and has interesting impact.įor example, from the HP 10bII+ User Guide p76: P/YR = 12 N = 360 I/YR = 7.75 PV = 180,000 FV = 0 End Mode finds PMT = -1,289.54. We hope that this process will keep the material current and flexible enough to help students gain not only a better grasp of finance, but also an interest in the field.I've used HP Time Value of Money (TVM) calculators and programs for decades and just realized that my HP 10bII+ (and likely other HP calculators), when doing Amortization math, round BAL and PMT and INT to the current display resolution before doing the math.

HP 10BII FINANCIAL CALCULATOR AMORT LICENSE

Using a Creative Commons license that allows users to modify it to their needs with their own additions or through adding other resources, it is intended as not the final product, but the starting point. Be sure to read the comments within the file (marked with a little red triangle on some of the cells) if you have questions. If you want to include extra payments, you enter them in the amortization table. With the explosion of Open Educational Resource materials over the past few years, we saw this as a tool that could be made available to faculty as a launching point for their courses. Whether you are a student or a practicing professional, the fast and powerful HP 10bll+ makes it easy to solve business. Simply enter your loan information in the cells with the white background and everything else is calculated automatically. Easily calculate loan payments, interest rates and conversions, standard deviation, percent, TVM, NPV, IRR, cash ows, and more. Youll be able to work quicker and more eciently with over 100 time-saving, easily-accessible busi-ness functions. Whether it is learning about time value of money, bonds, capital budgeting or retirement planning, this book should make that process as straight-forward as possible. The HP 10bII+ is the smart choice for business and nance needs. The goal was to create a resource to introduce students to the important elements that go into financial decision making which applies to corporations and their own personal lives in a simple framework. This book has been developed with over a decade of classroom use in both face-to-face and online classes at Pittsburg State University. Business Finance Essentials is a text designed to provide students with an opportunity to learn the fundamentals of business finance without the additional cost of a textbook.

0 kommentar(er)

0 kommentar(er)